Controversy in Northern New Hampshire

When a Large Timberland Owner Decides to Sell Carbon Instead of Cutting Timber

By Charles Levesque

In 2003, after two years of fundraising, grant writing, and legislation, The Trust for Public Land, a national land protection non-profit that had optioned 171,500 acres of timberland from International Paper in 2001 in northern New Hampshire, closed on a unique land protection deal. It sent 25,100 acres to the state of New Hampshire for wildlife and recreation and 146,400 acres to a timberland owner subject to a conservation easement that only left one economic use to the landowner for that property – timber. The land and project became known as the Connecticut Lakes Headwaters. Under this unique deal, the State of NH also took ownership of 269 miles of the over 425 miles of gravel timber roads on the property because they would be open to vehicular access for recreation.

Fast forward to 2023 and things are starting to spin out of control due to the market for selling forest carbon offsets (not contemplated in 2003) and the new owner of the private land, Bluesource Sustainable Forests Company. With new ownership, there came a new mission for the property. The Forestland Group (TFG), the former owner of Connecticut Lakes Headwaters, was primarily in the business of “managing natural forests to deliver financial returns.” Bluesource has a different mission than TFG, which is to be “the largest private forestland owner focused entirely on climate mitigation.”

In the July 2023 issue of the Northern Logger, I wrote that forest carbon markets are not affecting timber availability yet because there are so few acres under carbon projects in the US relative to the amount of forest being managed for timber. Well, I need to adjust that conclusion a little bit given this new twist on the Canadian border in New Hampshire.

In 2014, the previous owner, TFG, signed a 100-year contract to sell forest carbon on the land through the California compliance market under the Air Resources Board there. Selling forest carbon is so new that the conservation easement signed in 2003 didn’t even mention this. Under the carbon project, after getting paid one time for the standing forest carbon on the day the carbon contract was executed, the landowner could sell some of the carbon each year from additional carbon sequestered in the annual net growth of the forest. And TFG did just that. They also cut a lot of timber, too, because you can do both out of that net annual growth amount. Bluesource inherited that contract since the contract runs with the land.

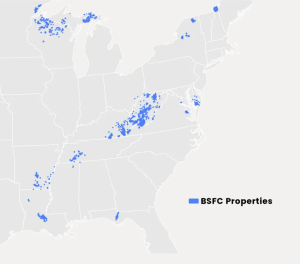

Bluesource purchased all of TFG’s timberlands in the US in 2022, about 1.2 million acres, and now owns over 1.7 million acres (see map). This land includes the Connecticut Lakes Headwaters property. In 2022 and up until July of 2023, Bluesource continued harvesting timber and selling carbon. In July of 2023, they announced that they would be curtailing all logging on the property in lieu of selling carbon for the rest of the year due to the decrease in timber prices we’ve recently seen in most of the US this year. Bluesource would make more money selling carbon than selling timber.

Ramifications of this decision are huge for the local economy in and around Pittsburg, NH, where most of the property resides. For many years, three to five logging contractors have been harvesting on the property nearly full-time. At least for the time being, they will not be harvesting on this property.

Can they find other harvesting work or will some of them go out of business? Two local mills, the Ethan Allen hardwood sawmill and furniture manufacturing plant just over the state line in northern Vermont, and a large spruce-fir mill, Milan Lumber, in Milan, NH, have procured a significant amount of logs from the property. Milan Lumber has gotten 20-30 percent of its softwood logs from this property. Both mills are saying this will really hurt their operations and the Milan mill is currently in a shutdown because they do not have enough logs to saw.

The landowner representatives from Bluesource are not putting any of this in writing but they have met with local people this summer and have listened to their consternation. They say that this could change if timber prices go up. Shawn Hagan, manager for the NH Bluesource tract, says they will come back with a new harvesting plan for 2024 that will likely be about half of what has been harvested annually in the last decade. In recent years, between 25,000 and 30,000 cords have been harvested annually.

Meanwhile, the three towns where this land is located, Pittsburg, Stewartstown, and Clarksville, are screaming because they receive timber tax from cutting on the land under state law. Pittsburg received over $175,000 in timber tax in the last year, over 20 percent of the town budget.

Politicians are getting involved at the state and federal levels, too. Some local politicians are suggesting they will file legislation in January. On what, exactly, is unclear. A similar outcry has started near properties Bluesource owns in West Virginia.

So, my conclusion that forest carbon offset markets are not affecting timber supplies now has an amendment. What will Bluesource’s actions lead to? Stay tuned.

Charles Levesque is President of the northeast-based consulting firm Innovative Natural Resource Solutions, LLC. He was involved in the Connecticut Lakes Headwaters property deal when it happened and currently sits on the advisory Connecticut Lakes Headwaters Citizens Committee for the property. He can be reached at [email protected].

Bluesource official website: https://anewclimate.com/bsfc